Hello everyone,

I want to create an admin panel for automating the loan credit and reimbursement process for our clients based on the following parameters:

- Client ID

- Loan amount

- Loan length (in months)

- Date of capital reception

- Date of first reimbursement (1st month)

- Interest rate

Is it possible to connect this admin panel to a workflow that will credit the loan amount on the date of capital reception and then debit the repayments from our system balance in the following months until the loan is fully repaid?

The admin panel could store the information in a table or Google Sheet, and a trigger could read this table every day, processing the credit/reimbursement of the line that corresponds to the date of an event. Is this possible?

Hi there!

The workflow you intend to build can be built on top of Retool.

You can simply create a new Workflow with the following modules:

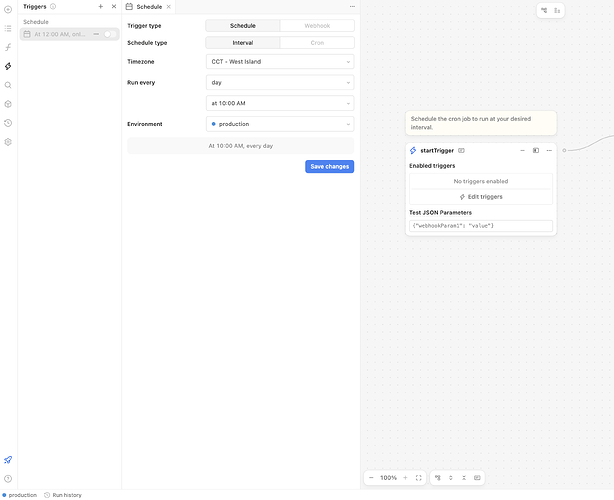

- Trigger: The trigger should be of type "Schedule" and it should run every day at a specific time (For example 10 AM). Look at the following image:

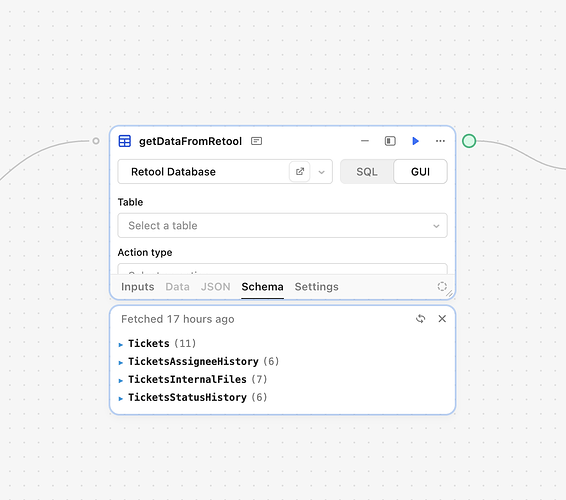

- Fetching Data: Next you need to fetch the data from your table. I suggest you to use Retool Database instead of Google Sheets. It is easier to work with in Retool environment and it's also more scalable. Following you can see the module and you only need to specify the table name that you have stored your data in.

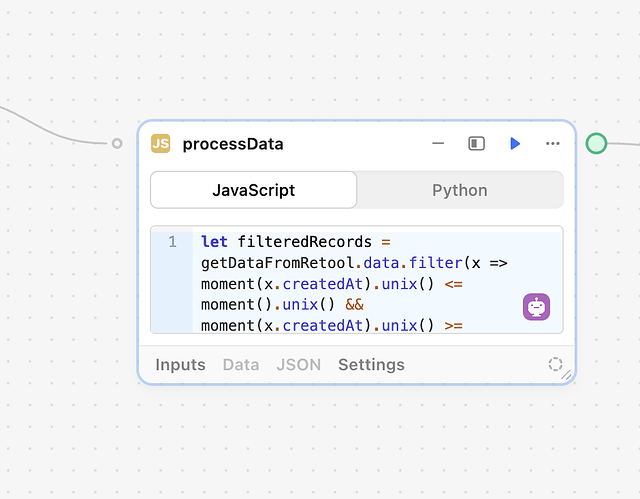

- Logic: Next you need a JS or Python simple script to find customers that should repay today. Your script should first look at the "Date of first reimbursement" for all customers; depending on the logic of your repayments intervals, you might have different algorithms for finding out if today is reimbursement date for a customer. For example if customers should repay on same date in each month (For example 8th of each month for people who started the reimbursement in 8th of July 2024), you should check for day of month and select customers that their day of "Date of first reimbursement" is today. You also should filter out customers that their " Date of capital reception" has passed and paid the full loan (If I understand this column meaning correctly :D). The last part of your script should be calculating the reimbursement amount based on loan "Loan Amount", "Loan Length", and "Interest rate".

- Action: As the last module, you can use a Resource Query Module (And select Retool Email or SMTP) to send an email notification to your customer. If you want to send SMS or WhatsApp message, you can use API Call Module and connect Retool to another provider. (Or you can directly use Twilio module)

I tried to explain the whole logic in this post. Let me know if you have any specific question on each of these steps. Start building and have fun!

Thanks so much @Alireza_Karimi ! Let me start crafting and I'll definitely circle back for more specific questions.

1 Like